Terms of Investment

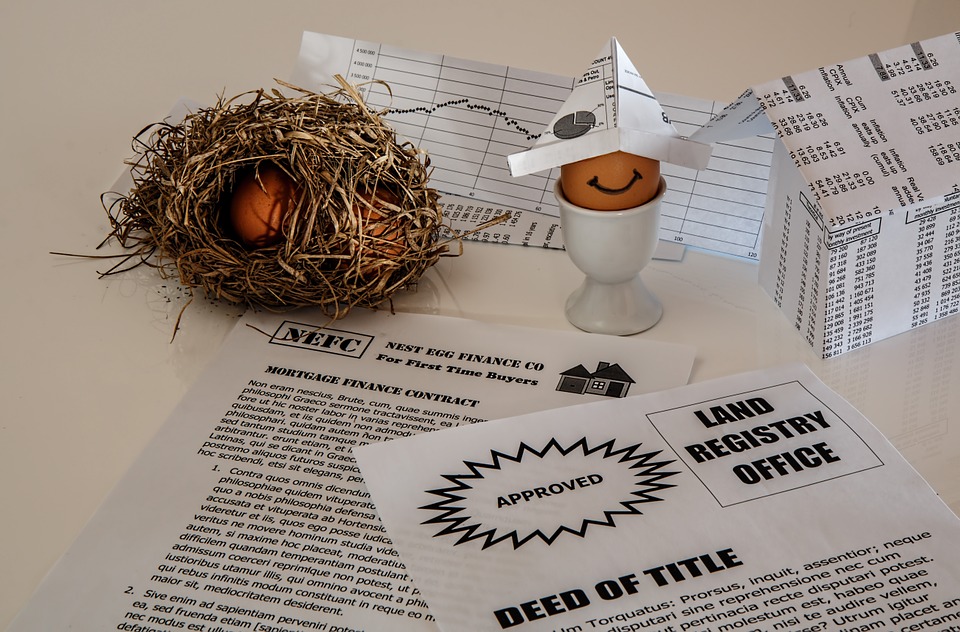

Property investment is about a desire to purchase property and to gain from potential financial growth.

Property Investment is it for you?

For newbies, if you are planning to enter the property market you will benefit from knowing some of the terms used by investors and media.

A journey starts with a single step forward. Let yours be one of adventure.

People, of course, invest in properties to make money, and so making a loss is never ideal.

You will hear the word gearing used a lot. The term ‘Gearing’ simply means borrowing money to buy an asset. But then of course there a different types of gearing.

What is negative gearing?

Negative gearing is when you borrow money to invest into an asset (usually a property) and the income you make from that investment, i.e. the rent, is less than your expenses, meaning that you’re making a loss.

What is neutral gearing?

Neutral gearing is when you borrow money to invest into an asset and the income you make from that investment, i.e. the rent, is equal to your expenses.

What is positive gearing?

Positive gearing is when you borrow money to invest into an asset and the income you make from that investment, i.e. the rent, is more than your expenses.

In short, negative gearing will make you money if the property’s long-term capital growth is greater than the loss you make in rental shortfall.

However, for negative gearing to work, investors need a reliable cash flow to cover pre-tax borrowing costs and to earn enough income to meet their loan repayments.

Capital Gain and Cash Flow

Every one talks about capital gain and cash flow.

What is capital gain?

Capital gain is the profit an investor makes after deducting the initial costs of property purchase and associated selling costs and it is taxable.

What is capital value growth?

Capital value growth may occur if a home’s amenity is improved with renovations or

extensions, or where there is a shortage of homes and/or strong demand from buyers.

What is cash-flow?

Cash-flow is what is left in an investor’s pocket once all regular ongoing costs are deducted from all regular income (rent).

What is negative cash-flow?

Negative cash-flow is a shortfall between the property’s weekly/monthly cash-flow and its loan repayments.

Finding a medium between capital value growth and regular cash flow should be the investors goal.

As for the finer details, that is best left to those who have the experience and knowledge to achieve the desired result…

…and if you don’t have a Financial Advisor, you should probably get one.

Always Research, Read, and Ask questions.

Reference

Need a Professional Settlement Agent / Conveyancing Team Supreme Settlements